RBI Tightens Rules for Offline Payments and Merchant KYC in 2025

Digital payments in India have experienced rapid growth over the past few years. From UPI to QR codes and wallet transactions, even small merchants in rural areas now accept digital payments. While this has improved financial inclusion, it has also raised risks of fraud, misuse of prepaid instruments, and money laundering. To strengthen security and ensure transparency, the Reserve Bank of India (RBI) has recently tightened rules for offline payments (payments without internet connectivity) and merchant KYC (Know Your Customer) compliance.

These changes are important for both businesses and customers to understand. Below, we break down the key rules in simple points.

Key Changes in RBI Rules

Here are the changes in RBI rules:

- Stricter Limits for Offline Payments

- Offline payments allow users to make small transactions without internet (using wallets, cards, or UPI Lite).

- Earlier, the limit was ₹200 per transaction and ₹2,000 overall.

- Now, RBI has tightened daily and per-device limits to prevent misuse.

- Customers must receive real-time SMS/email alerts for every offline transaction once the device connects online.

- Mandatory Reconciliation Timeline

- Payment aggregators, banks, and wallet providers must reconcile offline transactions within 24 hours of regaining network connectivity.

- This ensures that no fraudulent or duplicate entries remain pending.

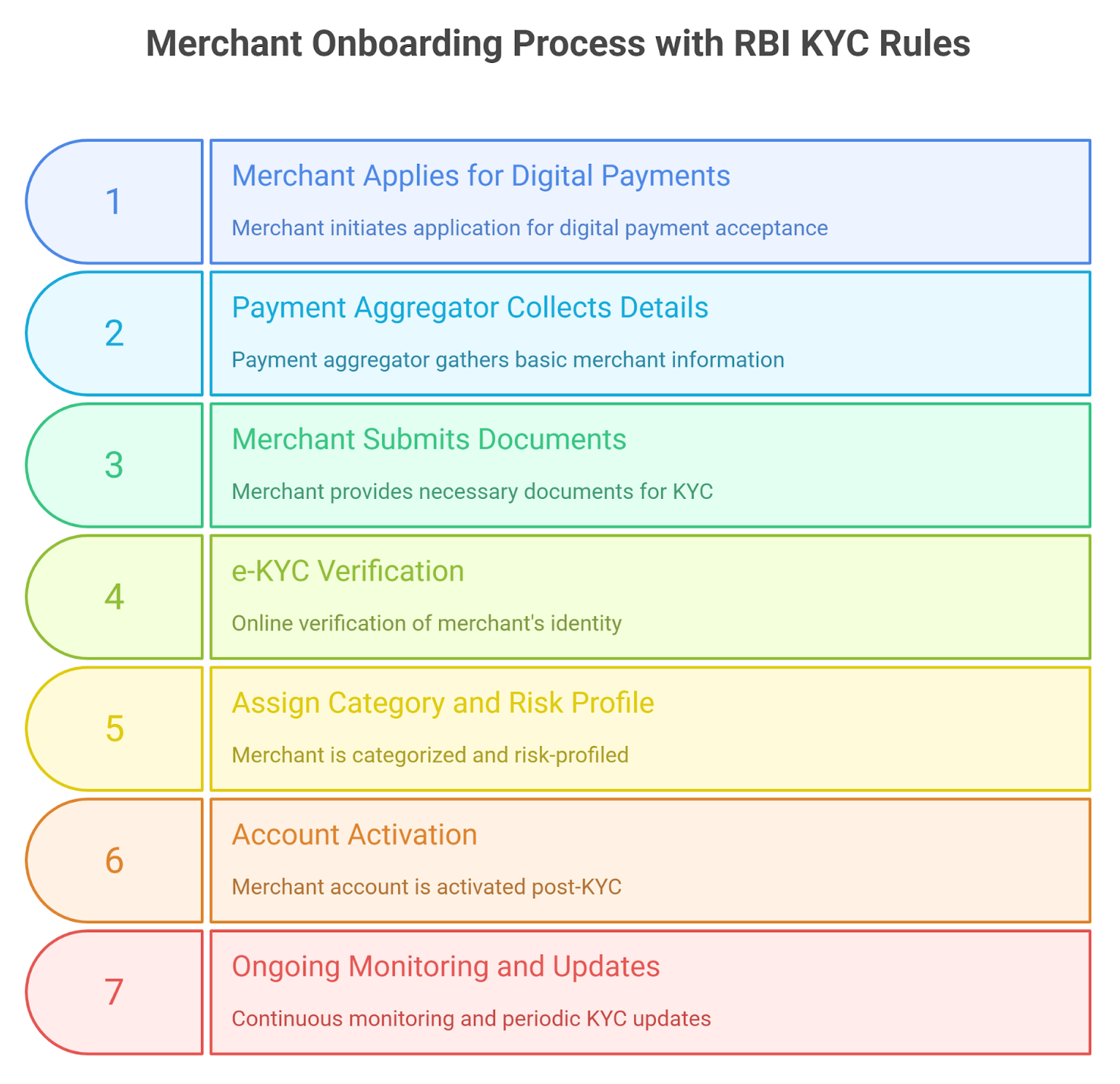

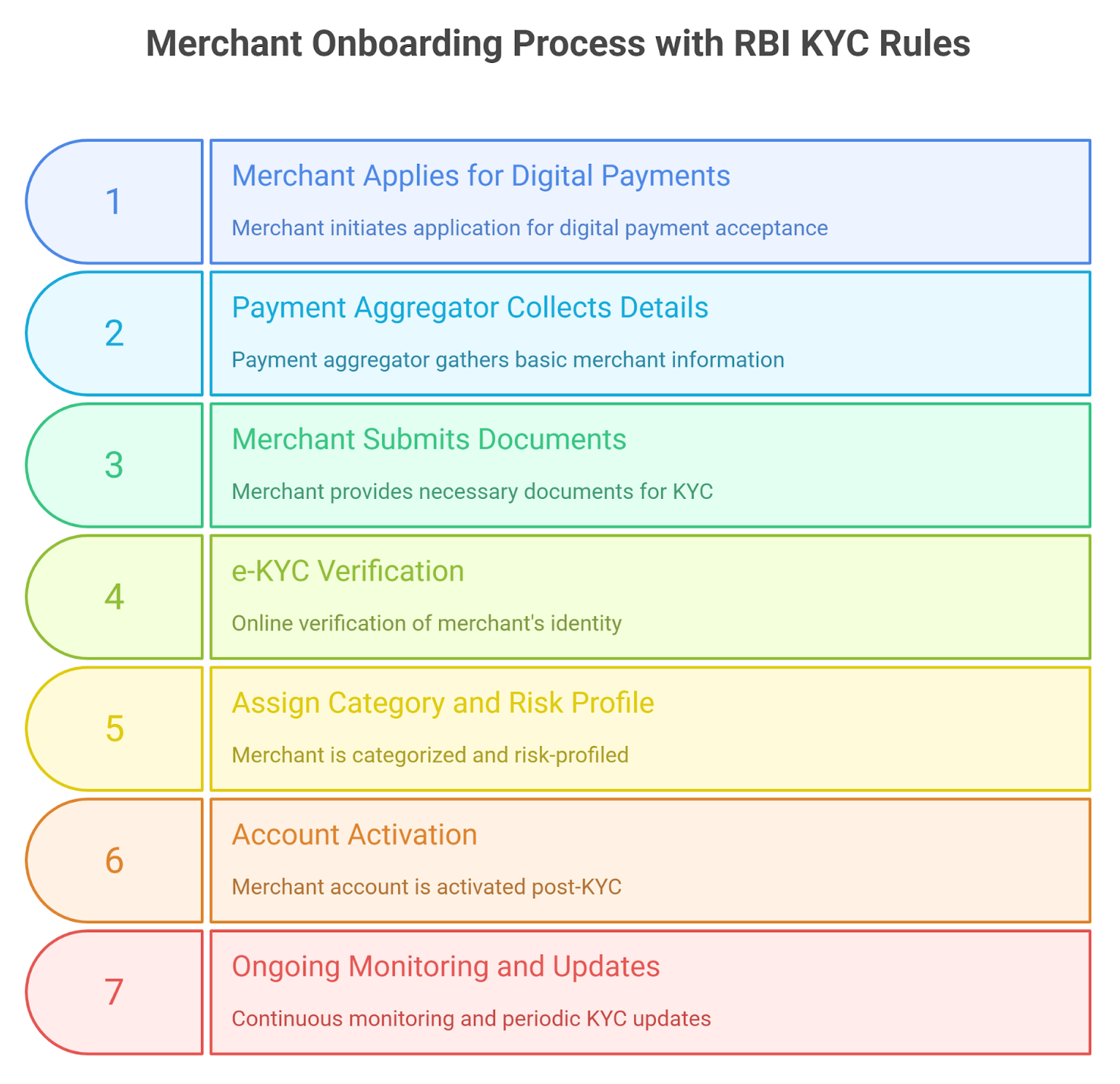

- Stronger Merchant KYC Norms

- All merchants accepting digital payments must now undergo full KYC verification (PAN, Aadhaar, business documents).

- Small merchants previously had relaxed norms, but now even small shopkeepers and street vendors must complete e-KYC to continue accepting UPI or wallet payments.

- The aim is to curb fake merchant accounts being used for fraud or money laundering.

- No Anonymous Merchant Onboarding

- Payment service providers can no longer allow merchants to accept payments with only minimal details.

- RBI has made it compulsory to capture merchant category, business address, and banking details before activation.

- Risk Monitoring & Transaction Alerts

- RBI has instructed payment providers to set up real-time risk monitoring systems.

- Suspicious activities like unusually high transactions, sudden spikes in volume, or location mismatches will trigger alerts.

- Merchants and customers will be immediately notified in case of suspicious activity.

- Periodic KYC Updates

- Just like banks require customers to update KYC periodically, merchants will now need to re-verify KYC every 2–3 years.

- Non-compliance can lead to suspension of merchant accounts.

- Higher Responsibility on Payment Aggregators

- Companies like Paytm, PhonePe, Google Pay, and banks that onboard merchants are now directly responsible for KYC failures or fraudulent accounts.

- RBI has asked them to conduct regular audits and report compliance status.

- Consumer Protection Measures

- Customers must be given clear refund timelines in case of failed offline transactions.

- RBI has directed providers to offer a dispute resolution mechanism within a fixed time.

Conclusion

The RBI’s new rules for offline payments and merchant KYC are meant to balance convenience with safety. While small merchants may initially find the stricter KYC process time-consuming, it will ultimately build trust in the digital payments ecosystem. For customers, these rules mean safer transactions, reduced fraud risks, and better transparency.

Digital payments in India are growing stronger, and these regulatory guardrails will ensure that the system remains secure, inclusive, and future-ready.

Leave a Comment